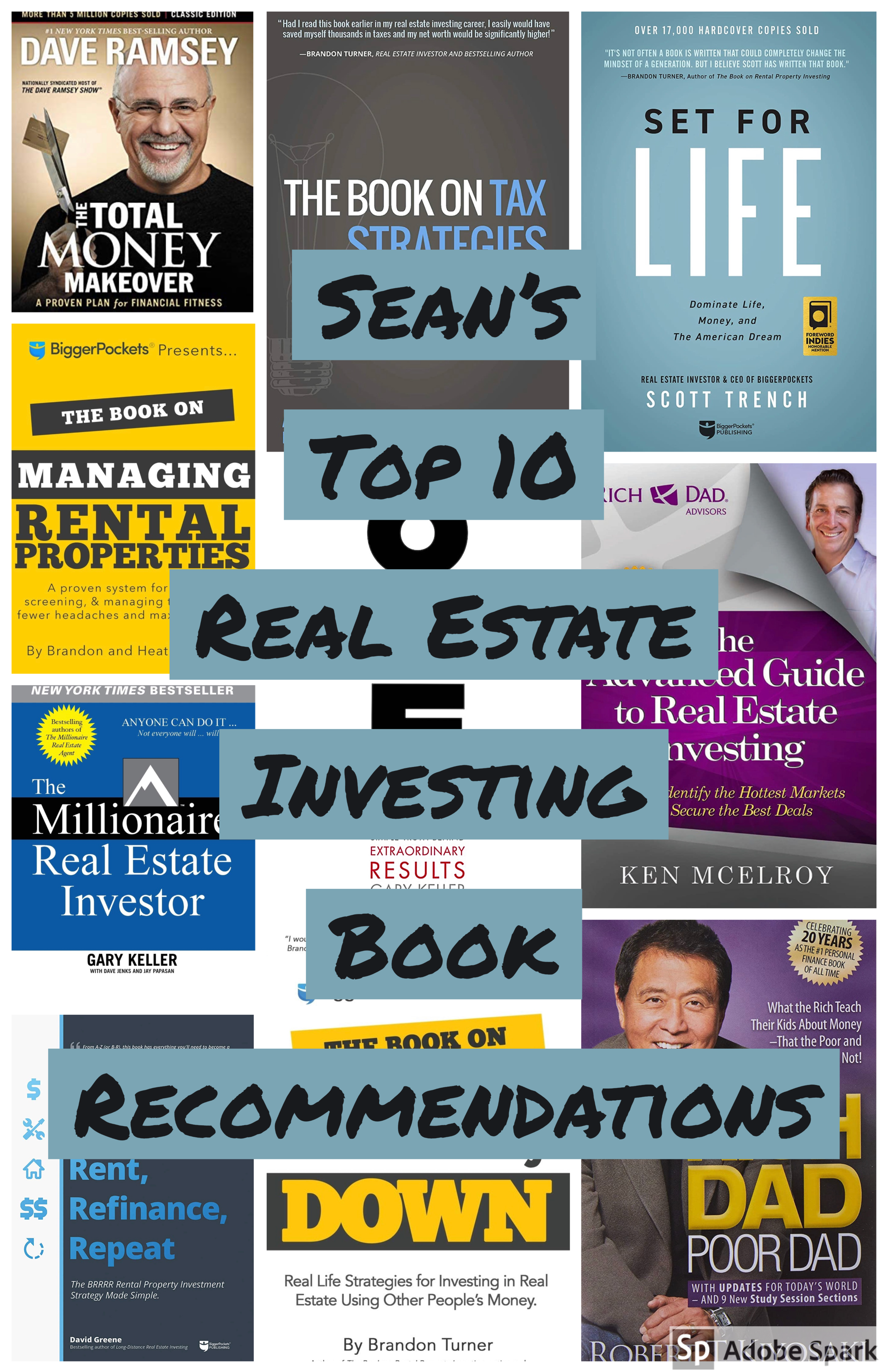

Sean’s Top 10 Real Estate Investing Book Recommendations

In the last five years of real estate investing, I’ve had a lot of life changing moments. It’s safe to say finding Brandon Turner and Bigger Pockets was one of the first. Little by little I started picking up real estate books on couldn’t stop educating myself and what I needed to do to invest in our first real estate property. One by one, my real estate library grew and now I have guys like Robert Kiyosaki and Scott Trench to thank for where I am today.

ALL of these books have been absolute game changers for me over the years. They range from real estate basics, making money on your taxes (for real,) financial freedom, goal achievement, money mindset, and many key real estate investing strategies that actually work! They are in no particular order and they all sit on the same shelf in my house! I’ve added the links to amazon for anyone who’d like to take the real estate knowledge plunge with me. These are not affiliate links with amazon. I’m just looking to spread advice and knowledge to those that are interested in journeying with me.

Why?

What I learned in this book was that “just because something seems simple when you read it does not mean it is simple in real life.” Ken breaks down real estate investing into simple keys and guidelines to follow. The real key though is remembering and internalizing that information in real life! Ken talks about truly researching and understanding a particular real estate market and the submarkets within it. Sounds simple right? But what happens when you forget to do your research and buy a house you “thought” was in a good school district but happens to be on the wrong side of the road and therefor in a not so desirable school district, in turn lowering the value of the home significantly? The ABC’s of real estate investing are exactly that, ABC’s, and my recommendation with this book is to take notes, memorize and internalize Ken’s lessons.

Why?

The millionaire real estate investor is PACKED with content for all investors to learn from. The biggest take away for me personally on this book was actually a concept that challenged me personally have “stricter” criteria for investments. The millionaire real estate investor says that you should put down 25% as a down payment on your properties to start BUT more importantly it says that you should AWLAYS buy your property at 25% less than the market value of the property. This protects you from buying a deal just to do it and forces you look for great deals instead of decent or ok deals. But guess what? Putting 25% down on a property is hard enough but add buying at 25% under the market value and now you have to work really hard and be very patient to find a deal...and that ain’t easy for someone like me who wants to rock and roll. But honestly I am glad I read this book early on in my investing career because I am sure I would have made some not so great deals just to do it if I had not.

So how do you really accomplish putting down 25% equity and 25% under market value?

You have to be willing to make more offers realizing many will get rejected but when you get one you will sing!

You need to start looking at auctions- auction.com, local auctions through your city (typically in the newspaper,) sheriff sales

Look at foreclosures and bank-owned or “re-po” (repossessed homes)

Start networking with savvy realtors in our area

Network/find wholesalers in your area

So that is how you FIND deals for 25% under market value but then you have to figure out how to put 25% down. Your options are: either save up 25% for each and every property (which really means 30% by the time you pay closing costs and everything else,) or BRRRR (my next favorite book!)

Why?

BRRRR stands for Buy-Renovate-Rent-Refiance-Repeat. This process has been around for a long time in real estate but Brandon Turner and David Greene have given this investing strategy a name that sticks! Remember when I listed the Millionaire Real Estate Investor above and asked “how are you going to put 25% down AND get your property at 25% below its market value? The BRRRR strategy is the answer. What if you could buy a fixer upper property, flip it, but instead of selling it you keep it?! Instead of selling the property for a profit you use that potential profit as your down payment on a refinance for a cash flowing, freshly renovated, rental!

I am sure you have lots of questions after that so let me break it down further with an example. Say you buy a condo for $80,000 that is in ROUGH shape. You put 20K into the property to get it not only looking decent but looking amazing. Now before you buy the property you figure out what the ARV (after-repair-value) is aka how much is this thing worth when you are all done? Well you realize that it will sell and/or appraise for 159K when you are done. So you go to a bank and say “hey,I have this property worth 159K and I want to refinance into a 30 year mortgage...can you help?” The bank then tells you no problem but you will need to put 25% down and that you should figure on another 3-5% in closing costs and fees. Well, since you are all in at 100K you actually have more than the needed 30% equity! In fact you might just end up getting PAID at the closing table depending on what funds you used to purchase the property. That took you from the buy-rehab-rent-refinance and now you are ready to repeat the process all over again! That is called creating money out of thin air! Pretty cool idea and David Greene does an incredible job of breaking this down so well. Definitely look at his discussion on “the velocity of money” in this book too because I love that concept as well!

Why?

Set for life changed my perspective on the “attainability” of building wealth. I would love to come up with the next Facebook or something but I do not want to have to bank on that in order to achieve financial freedom for me and my family. Set for life breaks down how to achieve financial freedom with a REGULAR job and simply being smart with your decisions. For example, you are looking to buy a house, you’re sick of paying rent right? Well what if you could buy a house and then have other people pay for your mortgage, taxes, insurance and heck maybe even PAY you to live there! Scott Trench breaks down how to do this with “house-hacking.” House-hacking is when you buy a house and then rent it out while you also live there. An example would be that you buy a duplex and live in half and rent the other half. Or maybe even buy a triplex or fourplex and do the same. The greatest part? If you are buying a place as your personal residence you can even use an FHA loan (3% down mortgage) to buy the place! If you run these numbers right you will most likely have massively cut down or even eliminated your biggest month to month expense! Imagine that instead of paying $600-$1500 per month in rent, that you are now throwing that money into the bank for another property, stocks, or just bulking up your savings. That’s the road map to exponential growth! And you can do all that while still focusing on crushing it at your day job if that is what you want. There is so much more that Scott covers in this book. A Must read!

Why?

The One Thing by Gary Keller has been SUCH an influential book in my life. I know this is not a real estate book but some principles in life transcend every industry and aspect of life. The One Thing challenges you to look at your dreams and not get lost with your head up in the clouds. Look at your dreams and then ask yourself “What is the ONE THING that I can do next that will have the largest impact in moving me closer to my goal/s?” Figure out what that thing is and then GET IT DONE! Do not worry about anything else. Once you complete that task/step ask yourself that same question over and over until you reach your goal. So for real estate, what is the most important next step for you? Is it gaining knowledge? Is it finding a mentor? Is it buying your first deal? Second deal? Figure out what that is an do it.

Why?

Rich Dad Poor Dad has been listed as the most influential real estate book by more people than I can possibly count. And there is a good reason. Robert Kyosaki uses his “parable” of the rich dad and poor dad to illustrate the difference between building REAL wealth vs working your whole life and having nothing to show for it. He shows the true power of real estate and breaks it down in such a simple way for readers to understand. This book is the gateway for so many new investors because it opens their eyes to the potential of what financial freedom through real estate can look like…and it did the same for me! This book helped me to dream of financial freedom through real estate for the first time.

7. The Book on Managing Rental Properties by Brandon and Heather C. Turner

Why?

This book was HUGE for me as a first time landlord. Brandon gets into the actual, real grit of being a landlord. He is not simply discussing the idea of being a landlord. He is literally walking you through screening tenants, lease agreements, check lists for walk throughs when a tenant leaves, and giving tons of real life examples of dealing with tenants. He even straight up GIVES you a huge list of PDF’s he and Heater his wife have made over the years and that they actually still use! Again...HUGE. I literally have all of these PDF’s saved in my Google Drive and have used many of them over the years with my own rentals. Cannot say enough that Brandon gives you the real actual details that you need as a landlord. And honestly this book is not simply for the “first time” landlord. There is such a wealth of knowledge in this book for investors of all status’ to learn from.

Why?

I think most real estate investors love what they do, they LOVE investing in real estate but most of them HATE doing taxes! This book by bigger pockets takes all of the “I want to gouge me eyes out” feelings that come from trying to get your books straight every year and ACTUALLY gets you excited about taxes! Seriously, the one thing that makes taxes exacting for an investor is the idea of actually saving money when they are done correctly! Like many investors, I love games, and when you tell me that if I play this tax game correctly I will make back thousands of dollars each year…GAME ON!

Why?

Again here I have another “non-real estate related book” but man I will tell you: If you do not know how to handle your personal finances and handle a budget then you have no business being a real estate investor. My wife and I did Dave Ramsey’s Financial Peace University when we were engaged and Ann always hears me telling people that finances are one of Ann and my top strengths as a couple…hands down. Using Dave Ramsey’s philosophies literally paved the path for Ann and I to be where we are today. We had $93,000 in student loans when we first got married and we paid it off in three years because of Dave’s teaching. MORE importantly than paying off personal debt, Dave taught Ann and I how to communicate about money as a couple AND how to save. As soon as we finished paying off our student loans we started throwing that money into our savings. The money that we saved is what gave us the ability to jump into real estate full time without having to worry about paying the bills next month. It gave us the ability to focus completely on our first VA Beach flip at project Gilpin and not worry about getting paid for 13-14 weeks! A great building block for your family or real estate empire.

…Now I will say that Dave is really anti-credit cards, anti-30 year mortgages for the most part, and not big into borrowing money (all things we do.) But I believe that he is against those things for people who cannot handle this responsibly. Credit cards are a great tool if used well. For example Ann and I literally make several hundred dollars each year with our Amazon card. I literally MADE $400 on our first flip just from using my PNC business card. We use them just like debit cards, never spend more than we have and pay them off every month.

Why?

I call this the “book of hope” for budding real estate investors. I remember reading rich dad poor dad and being absolutely sold on the idea of financial freedom through real estate but HOW the heck was I going to get started? Not only are you a newbie but you ain’t got no CASH man! Brandon literally wrote this book to help people who had low and NO money in order to get started in real estate. As an example, guess how much money I put as a down payment on Project Gilpin which we bought for around 100K? ZERO! Straight up. The only thing I paid for upfront was a few grand in closing costs and an earnest money deposit of $1,000. I mean that is crazy right? But is happens every day. Brandon is giving you the tools that you can put in your real estate tool belt. But it is up to you to bring this stuff to life. After reading this book you will no longer be able to say “I want to invest in real estate but I just do not have any money to get started.” No more excuses.

I love all of these books and I hope that they are as helpful to you as they have been to me! Many of these books I have read several times over because they are so jam packed with knowledge. Let me know what you think of any of these reads and feel free to shoot me your top real estate books as well! Find us on Instagram or send me a message. As always, I’d love to hear from you. Peace out!

Sean | INVEST